Demystifying 401(k) Pricing: Making Informed Choices

Navigating 401(k) pricing can be daunting, especially when you’re exploring it for the first time or comparing plans. Our goal is to simplify this journey for you by providing clarity and guidance.

It’s essential to be informed about some of the subtleties in 401(k) pricing. For instance, while terms like “employee pricing” might sound straightforward, they often refer to asset under management (AUM) fees. Such fees can accumulate over time, impacting the growth of your account.

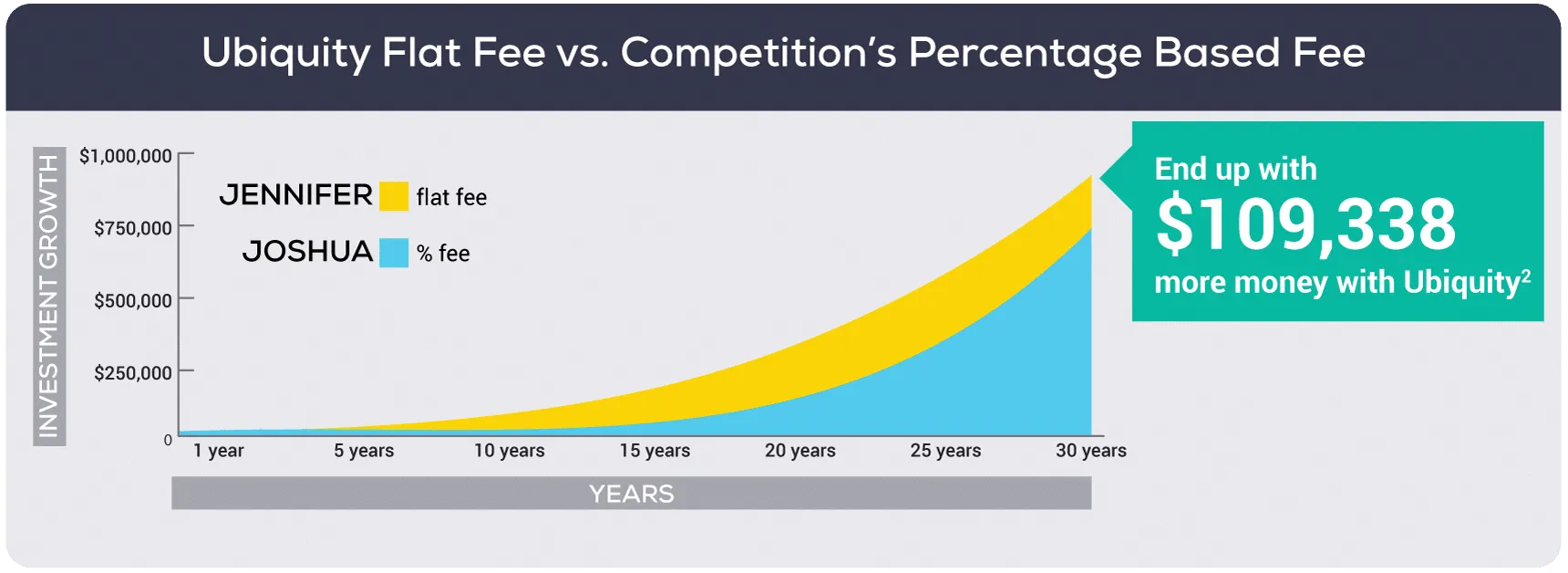

A Comparative Analysis: Flat Fees vs. Percentage-based Fees

Consider Jennifer and Joshua. Both start with 401(k)s valued at $50,000. Jennifer’s plan with Ubiquity Retirement + Savings incurs a flat fee of $6/month with an investment expense fee of 0.17%. Joshua’s plan is percentage-based, charging 0.50% annually along with an investment expense fee of 0.17%. Assuming no further contributions and an average annual growth of 10%, after 30 years:

- Jennifer’s account: $823,470 with total fees of $14,142.

- Joshua’s account: $714,132 with total fees of $50,217.

The difference? Ubiquity’s flat fees could mean potentially saving $109,338 over 30 years when compared to percentage-based fees.

Strategies to Optimize 401(k) Pricing

- Opt for 401(k) providers offering flat fees

- Inquire about percentage-based fees upfront

- Consult with HR, financial advisors, or third-party administrators about potential AUM fees

- Advocate for plans without percentage-based fees. Remember, every penny saved in fees can contribute to your retirement growth

- Consider starting with trusted providers like Ubiquity, which ensures transparency and cost-efficiency from the outset

The Key Takeaway

401(k) fees, especially those that grow over time, can have a significant impact on your retirement savings. Flat fees offer predictability, ensuring that as your account grows, the fees remain constant.

Always be vigilant about percentage-based fees, which can escalate over time, diminishing your hard-earned savings. Make choices that prioritize your financial well-being and maximize your retirement potential.