Secure 2.0 Made Simple for Small Businesses

Everyone

State-Mandated Retirement Plans for Small Businesses

Everyone

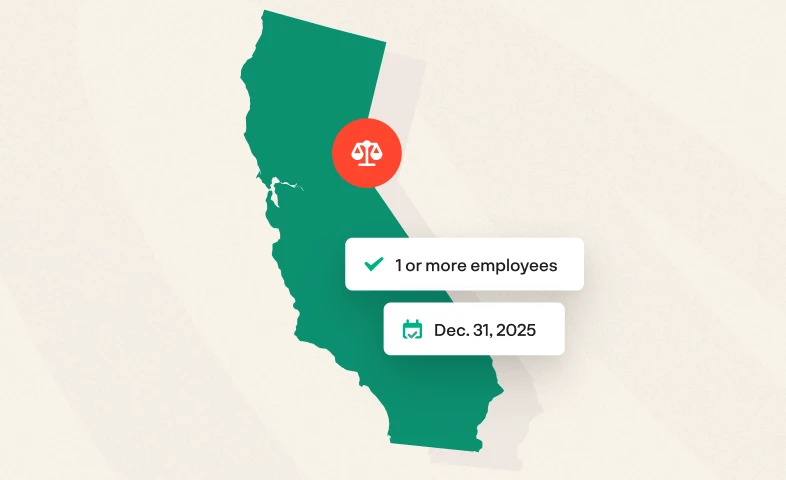

CalSavers Explained: Timeline, Requirements, & Specifications

Everyone

Employers & Business Owners

RetirePath VA Explained: Timeline, Requirements, & Specifications

Everyone

Employers & Business Owners

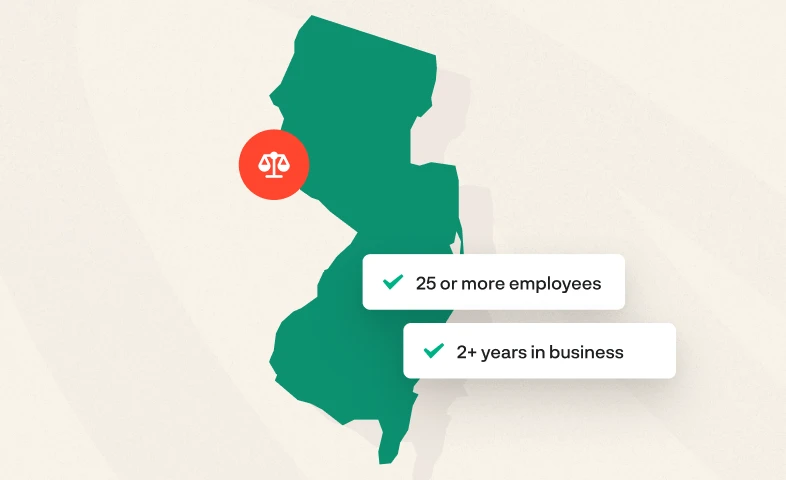

RetireReady NJ Explained: Timeline, Requirements, & Specifications

Everyone

Employers & Business Owners

401(k) vs. State-Mandated Plans: Understanding What's Right for Your Business

Everyone

Employers & Business Owners

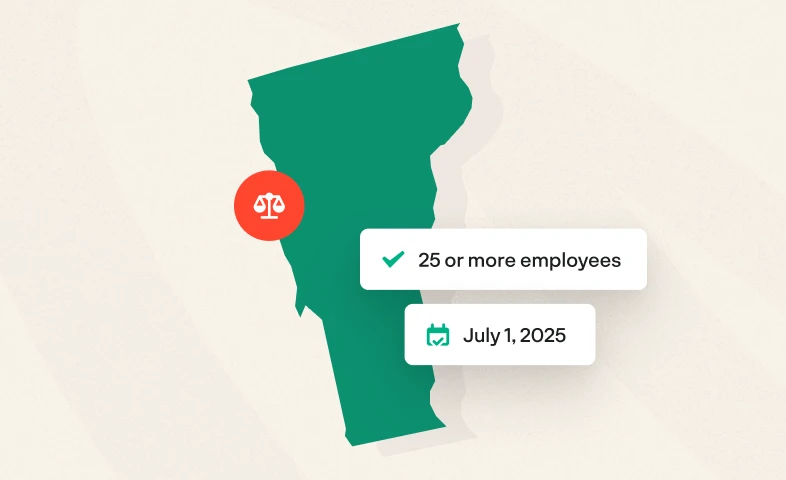

Vermont Saves Explained: Timeline, Requirements, & Specifications

Everyone

Employers & Business Owners

The Small Business Owner’s Guide to State-Mandated Retirement Plans

Everyone

Employers & Business Owners

Catch-Up Contributions and SECURE 2.0: What to Know and Next Steps

Everyone

Employees

SECURE Act Explained: Plan Eligibility for Long-Term Part-Time Employees

Everyone

Employers & Business Owners